Salary.com shows the average base salary (core compensation), as well as the average total cash compensation for the job of Accountant I in the United States. Compliance officers oversee organizations’ adherence to safety standards, licensure regulations, and other compliance measures. A bachelor’s degree is typically required for the role, but some compliance officers may also pursue certifications to advance their careers. Additionally, several top industries in Arkansas require accounting specialists to perform financial management duties. Advanced manufacturing, financial services and technologies, and healthcare are a few prominent industries in the state that require accountants.

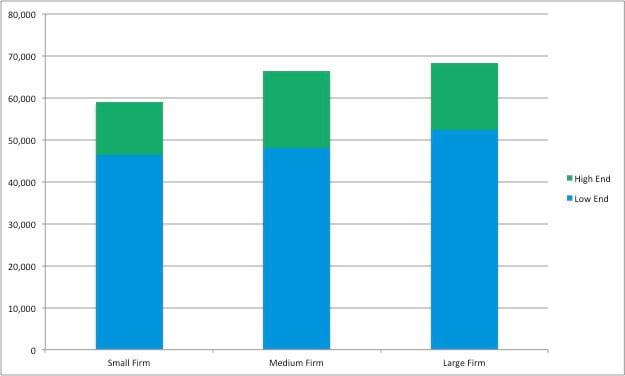

What are the highest and lowest Cpa salaries in AR?

As you can see from the BLS data above, Arkansas salaries for accounting professionals tend to be lower than national averages. These professionals help individuals create a financial strategy to meet their goals, such as paying off debt or planning for retirement. Entry-level personal financial advisors typically possess bachelor’s degrees, but some employers may prefer master’s-level candidates or certified financial planners. Several of Arkansas’ most popular colleges and universities, including the University of Arkansas and Arkansas State University, offer accounting programs.

Salaries by city in Arkansas

Forensic CPA’s use skills to collect and analyze data that is sometimes hidden to uncover many types of fraud such as money laundering, securities fraud, and embezzlement. These CPA roles are typically found in law enforcement, governmental agencies, banking, and insurance. According to BLS data from May 2021, accountants and auditors earn $69,410 on average. However, salaries for other accounting professionals in the state vary. For example, property appraisers earn an average of $41,390, while personal financial advisors earn an average salary of $110,900.

Highest Paying Cities in Arkansas for Accountant I

After passing the exam and becoming licensed, each licensee must take one hour of ethics training through the ASBPA and three additional hours of ethics every three years. They also need to complete at least 40 continuing education credits within the year before their license expiration date. Every state has specific requirements for CPA initial licensure and renewal. The Arkansas State Board of Public Accountancy (ASBPA) oversees Arkansas accounting requirements for CPAs. Still, the Big Four accounting firms have a presence within Arkansas, particularly in the Bentonville and Little Rock metropolitan areas. Bentonville ranks second in Arkansas’ best places to live by the Chamber of Commerce for its healthy economy, mix of Fortune 500 companies, and high-paying jobs.

- The average salary for an accountant in Arkansas is around $61,770 per year.

- Compliance officers oversee organizations’ adherence to safety standards, licensure regulations, and other compliance measures.

- Degree-seekers have several options when paying for college, navigating possible concentrations, and choosing learning formats.

- Explore potential accounting careers and Arkansas employment trends below.

Relevant Jobs of CPA Accountant

The BLS also projects economic health and accounting needs to grow together. News Economy Rankings, indicating that the demand for accountants in the state may not align with national demand. Colleges in Arkansas tend to cluster around more populated areas, like Little Rock and Bentonville.

Tax Professional – CPA – Work From Home – 2+Yrs Paid Tax Experience Required

Arkansas is also home to the unique Arkansas Scholarship Lottery, which has awarded over $4 billion in scholarships since 2009. The state also provides an easy-to-use scholarship search tool to help degree-seekers fund their education. With one of the country’s lowest cost of living indexes, Arkansas offers an affordable option for many aspiring accountants. Accounting students who prefer a blend of online and on-campus learning can consider hybrid delivery. These programs require learners to attend classes on campus at least part time.

Arkansas schools typically reserve the lowest tuition rates for in-state learners. Explore this guide for accounting requirements, what pursuing an accounting degree in Arkansas looks like, and accounting employment data for the state. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us.

On this page, you will find further information about the factors that impact accountant salaries as well as a table outlining the best states for accountants. The best states for accountants are weighted by the percentage the average salary cpa salary arkansas buys of the median list price for homes in a given state and the projected job growth. This data can provide insight on whether accounting job growth and salary potential justify the costs of attending a master’s in accounting program.

These programs typically provide an excellent mix of math, accounting, and business topics to prepare learners for work in the state’s various industries. Institutional accreditation is the most sought-after among schools and employers. Schools with Arkansas accounting programs may most commonly be accredited regionally by the Higher Learning Commission (HLC). HLC currently accredits Arkansas State University and the University of Arkansas, both of which offer accounting programs.

Degree-seekers who work full time may prefer a hybrid format for scheduling flexibility. Online accounting programs generally apply the same curriculum and expectations as on-campus programs. However, online students must remain self-motivated and able to learn concepts without as much instructor guidance.

Learners can also save on tuition by taking advantage of state reciprocity agreements, which allow out-of-state learners to qualify for Arkansas in-state tuition. For example, the University of Arkansas gives in-state tuition to students from Texas’ Texarkana and Bowie County areas. The breadth of key industries in Arkansas, such as retail, transportation, and food processing, creates a solid foundation for various types of accountants to find work. Patient billing specialists, financial analysts, and audit and reimbursement specialists are among the most in-demand positions for Arkansas accountants. Salary.com job board provides millions of Accountant I information for you to search for.