QuickBooks Online Review 2024: Features, Pros & Cons

Get a feel for what QuickBooks can do and try out top features using our sample company. Katherine Haan is a small business owner with nearly two decades of experience helping other business owners increase their incomes. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website.

Four pricing plans for QuickBooks Online are available, ranging from $35 to $235/month (with an additional $50+/month for payroll). Perhaps the biggest area where QuickBooks Desktop falls short is that its Pro cash flow from financing activities and Premier versions will soon be discontinued for new users. While QuickBooks Enterprise will still be an option, this is powerful software with an expensive price tag that will be too much (in terms of features and pricing) for most small businesses. QuickBooks Online is cloud based, which means you can access your QuickBooks account anywhere you have the internet and an internet-enabled device.

To delve deeper into our best small business accounting software, we tested and used each platform to evaluate how the features perform against our metrics. This hands-on approach helps us strengthen our accounting software expertise and deliver on the Fit Small Business mission of providing the best answers to your small business questions. In addition, QuickBooks Solopreneur, a new and improved version of QuickBooks Self-Employed, is designed for one-person businesses and is available for $20 monthly.

The right fit for all kinds of businesses

- QuickBooks Online is a leader in the accounting industry with it being the bookkeeping software of choice for many accountants, certified public accountants (CPAs) and bookkeepers.

- POs are essential because they help you specify what products and services you need from your vendor or supplier and by when you need them.

- The software must have features that allow users to set sales tax rates, apply them to invoices, and enable users to pay sales tax liability.

- QuickBooks Online offers over 80 reports depending on your plan, whereas QuickBooks Desktop Pro has over 130 reports.

- Even after initial setup, the software must also let users modify information like company name, address, entity type, fiscal year-end, and other company information.

- Add payroll to QuickBooks Online starting at $45 per month, or to Desktop starting at $50, plus $2 per employee, per month.

For an extra $50, sign up for a one-time live Bookkeeping setup with any of its plans. Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity. The editorial content on this page is not provided by any of the companies mentioned and has not been reviewed, approved or otherwise endorsed by any of these entities. The vendors that appear on this list were chosen by subject matter experts on the basis of product quality, wide usage and availability, and positive reputation. By providing feedback on how we can improve, you can earn gift cards and get early access to new features.

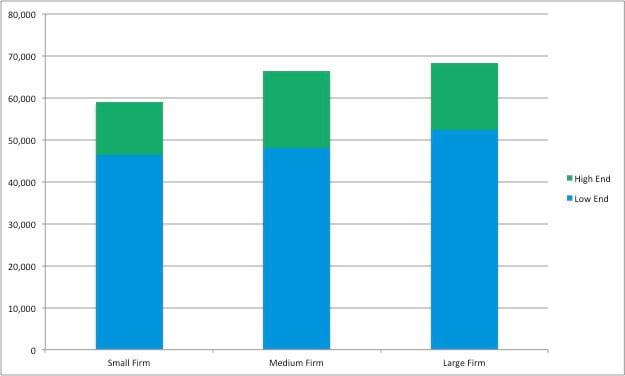

QuickBooks Online and QuickBooks Desktop starting plans and prices

Going completely cloud-based comes with marginally higher security risks. While QuickBooks Online does offer security features like multi-factor authorization and encrypted data storage, it’s accessible by anyone with employee login credentials and an internet connection. You can also integrate QuickBooks Online with Zapier, which lets you connect QuickBooks to thousands of other apps in your business’s tech stack. You can do things like automatically add customers to or create receipts in QuickBooks when payments happen in other apps, or track new QuickBooks invoices or payments in another app.

Which version of QuickBooks Online is best if I need to track inventory and manage projects?

The software must also have a mobile app to enable users to perform accounting tasks even when away from their laptops or desktops. The software must have features that allow users to set sales tax rates, apply them to invoices, and enable users to pay sales tax liability. The banking section of this case study focuses on cash management, bank reconciliation, and bank feed connections. The software must have bank integrations to automatically feed bank or card transactions.

See why more businesses are choosing QuickBooks Online

Add payroll to QuickBooks Online starting at $45 per month, or to Desktop starting at $50, plus $2 per employee, per month. QuickBooks Desktop is an annual subscription, starting at $549.99 per year, which may be cost-prohibitive for small businesses or cash-strapped startups. While the Desktop version has app integrations, it doesn’t have near as many as the Online version.